The Nigerian National Petroleum Company Ltd has secured a $5bn corporate finance commitment from the African Export Import Bank to fund major investments in Nigeria’s Upstream sector.

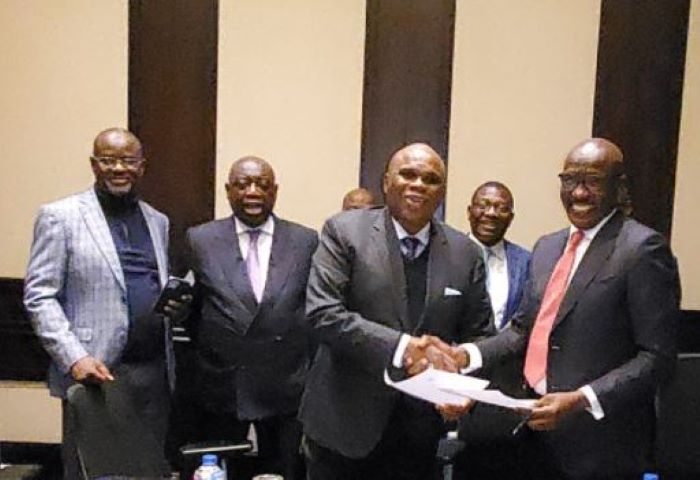

The funding commitment is a fallout of the meeting between the Chairman of the Board of Directors and President of the African Export-Import Bank( Afreximbank), Prof Benedict Oramah; and the NNPC Ltd team led by the Group Managing Director/Chief Executive Officer , Malam Mele Kyari, in Cairo, Egypt on Wednesday.

Kyari was accompanied on the trip by the Chief Financial Officer, Umar Ajiya; the Group Executive Director , Upstream, Engr. Adokiye Tombomieye; the Group General Manager, NAPIMS, Mr. Bala Wunti; the Managing Director, NNPC Trading, Mr Lawal Sade, and others.

The move is a major milestone achievement in the quest for the corporation to scale up investments in the oil and gas industry following the commencement of the implementation of the Petroleum Industry Act.

The PIA was signed into law by President Muhammadu Buhari on 16th August, 2021.

Following the assent of the President, the NNPC LTD was incorporated by the Corporate Affairs Commission on September 22 last year after it received application for its registration from the Federal Government.

The new legislation has provided business opportunities that will enable the NNPC earn more revenue for the country and attract foreign direct investment into the Nigerian energy sector

The PIA has also raised stakeholders expectations on the company, even as it has given it a wide room to stimulate investments in the oil and gas industry.

The NNPC’s $5bn corporate finance commitment from Afreximbank is seen by oil industry stakeholders as a dividend of the Petroleum Industry Act and the incorporation of the NNPC as a limited liability company.

Under the NNPC Ltd funding strategy for selected upstream investments, the Company would be raising between $3.5bn and $5bn as corporate finance to fund major upstream investments.

To achieve this objective, the NNPC plans to take over ownership from non-investing partner through acquisition of pre-emption rights in the sample Joint Venture.

The NNPC’s strategy would also see the company investing in assets to address integrity, bottlenecking and growth issues including rig-less activities, and drilling campaigns in the oil industry.

Culled from thewhistler.ng